When Virtual Reality Was Always Virtual

Fuji Real 3D W1 – top or flop?

The Fuji W1 already hit shelves in japan last year, but it took a while untill you could see it everywhere else. Now i got my very own one and tested it a bit. OK it is not really directly related to Virtual Reality and also not really an artifact i used...

A VR Who’s Who From 1994 – uniVRsum

1994 marks the peak of what many view as the first "Big Bubble" in VR popularity. There were literally hundreds of (mostly) entrepreneurial startups taking a wild fling and what seemed to be a game-changing technology. You could strike sparks anywhere! By 1997 most...

Oculus DK2 Lens – Characteristics

The Oculus DK2 is a remarkable VR headset, producing a remarkably wide field of view with very inexpensive single element optics. VRtifacts was curious about the characteristics of the Oculus DK2 lens: what size, what material, and what focal length? The lenses...

The State Of Consumer VR

Two milkshakes make the whole issue of virtual reality motion sickness moot. There's not much more commentary to add here...

Recent Job Posting: Seeking – Principal Teledildonics Integration Engineer

According to several women writers, a hot hi-tech hiring wave will be seeking: Teledildonics Integration Engineers and Fleshlight API Programmers (FAPs.) While porn has been trying to edge into Virtual Reality Sex, and VR keeps trying to penetrate the porn market,...

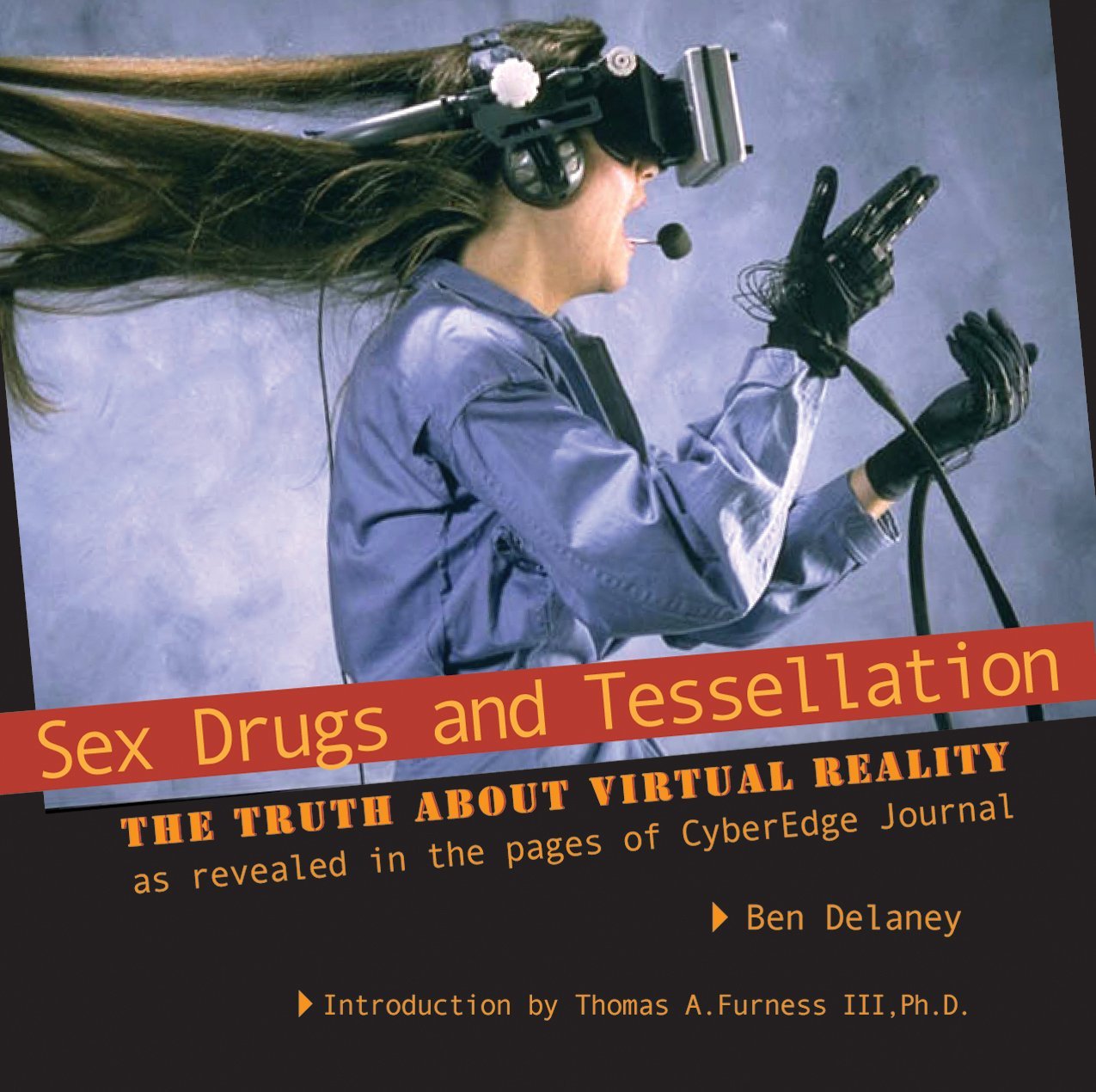

Bookshelf: Sex, Drugs and Tessellation

Hot off the press is Ben Delaney's authoritative new book, Sex, Drugs, and Tessellation which collects 6 years of wisdom from Ben's CyberEdge Journal, the go-to virtual reality publication from 1991 through 1996. Ben has always been both a proponent of,...

Why Sell Out? Oculus -> Facebook

A lot of people are fuming over today's announcement that Facebook would be buying Palmer Luckey's Oculus. Palmer and company produced two mainstream marketed development kit head mounted displays which became darlings of the grassroots VR/Gamer community. Starting...

W-Industries Unscripted

W-Industries (Virtuality) always seemed to have a PR person riding herd on any video material that was released about the company or products. Everything the public saw was tightly scripted and edited. But... here's a 1992 video from...

Virtual Reality (1991) – “Many Believe It Will Revolutionize The Way We Live”

ABC Primetime covers the VR scene in Sept. 1991. Although this news report conflates computer animation footage with Virtual Reality, it also features interviews with Jon Waldern, Fred Brooks, Howard Rheingold, Mike McGreevey, and C L Dodgson (virtually,...

The Realism Of 3D Movies

Speechless!!

The Great Bubble

2013 has brought much excitement to the VR world, especially the perception of great breakthroughs in Head Mounted Display products. Can we take a deep breath, then hold up a distant mirror to the cautionary history of VR from 1993-1998. Back...

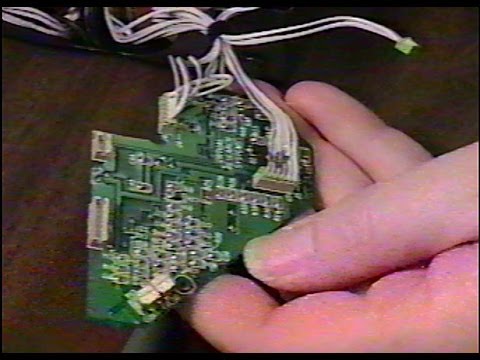

Vintage VR-4 Head Mounted Display Teardown

Here's a much more detailed tear down of the Virtual Research VR-4 Head Mounted Display, done by one of the engineers at VR sometime in 1994. He shows us how to remove the back light inverter and the main PCB. 'Scuse the vintage VHS EP mode recording. I...